Nigeria's palm oil industry is a stark testament to the fragility of economic potential. Once a global leader, the country's dominance in palm oil production symbolised its agricultural might and immense prospect. However, over the decades, this once-flourishing sector has wilted, turning Nigeria from a leading exporter to a net importer of palm oil. This dramatic decline is not merely a tale of economic loss but a profound lesson of squandered opportunities and systemic failures that can undermine a nation's prospects.

Analysing Nigeria’s palm oil industry raises two critical questions: how did the country lose its dominance? How can it reclaim this lost glory? To answer these questions, this article provides a historical overview of the industry and its current state and proffers practical, sustainable solutions for its revival.

A legacy in peril - 20 billion dollars lost opportunity

Nigeria’s decline in the palm oil trade can be traced to a series of missteps: failure to invest in the plantation of improved oil palm varieties, an unfair pricing system that disincentivize farming, infrastructure shortages, and the disruptive impact of the civil war.

Over reliance on the wild and semi-wild groves and their variety undermined the long-term competitiveness of Nigeria’s oil palm sector. With its thick shell and inefficient oil yield, the dominant dura palm species couldn't compete with the high-yield, disease-resistant varieties emerging in Southeast Asia.

Also, prices offered to palm oil farmers by the commodity marketing boards (CMB) were, for long periods, very low or nearly half the international market price, effectively undercutting farmers' profitability. The CMBs’ policies and interventions worsened price instability, contrary to their stabilizing mandate. Moreover, the CMBs’ mismanagement of funds, including diverting resources meant for agricultural stabilization to other projects, further compounded the challenges faced by palm oil farmers, thereby discouraging production.

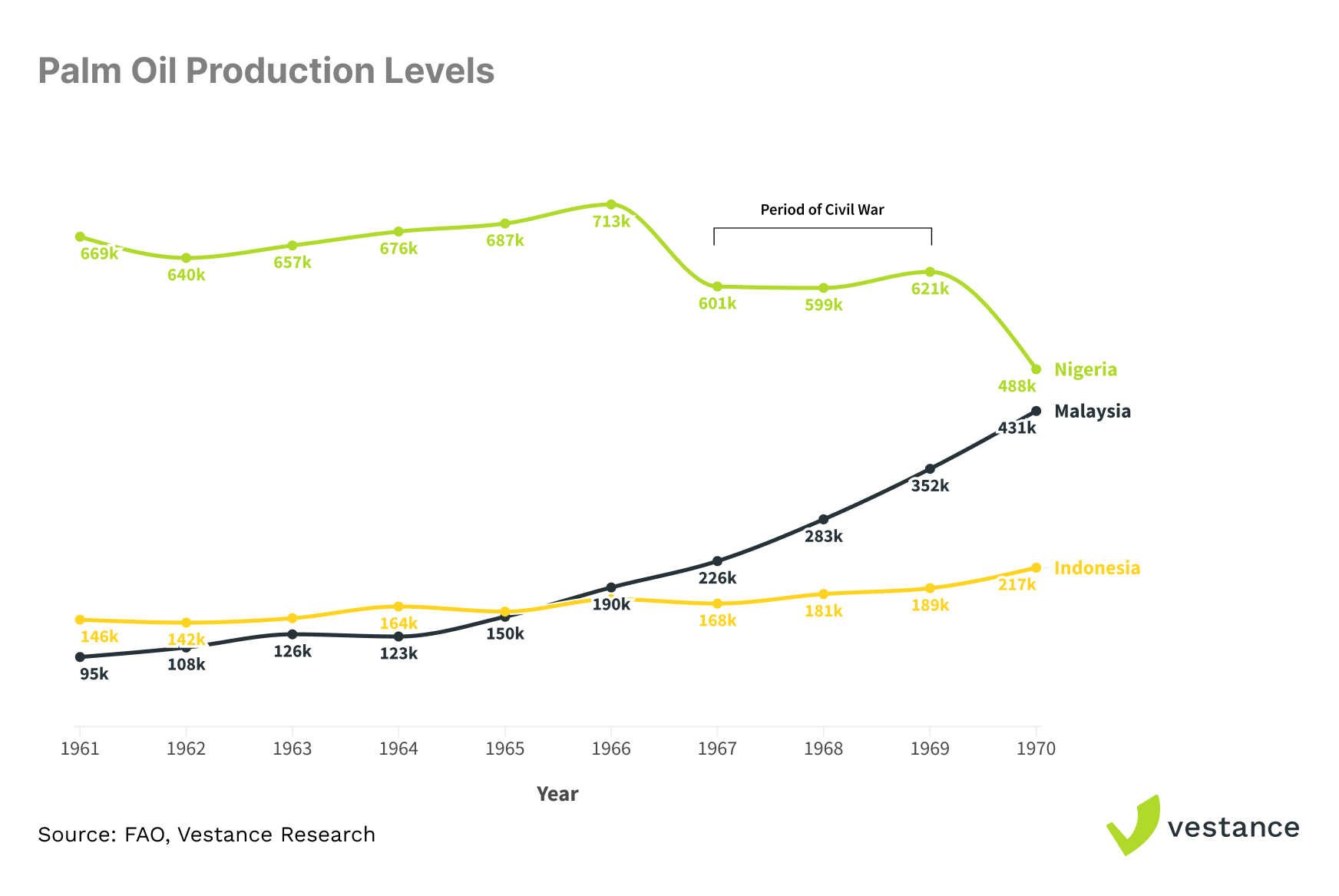

In addition, limited investment in infrastructure and the disruptive Nigerian Civil War (1967-1970) significantly hampered Nigeria's palm oil industry. The war broke out in the southern-eastern region (the oil rivers), a key area for palm oil production, creating a ripple effect that disrupted output, hindered long-term recovery, and stifled modernization efforts.

The figure illustrates the effect of the civil war and the start of a downward trend in Nigeria’s palm oil production (Tonnes)

This tipping point contrasted starkly with Southeast Asia, particularly Indonesia and Malaysia, which embraced:

Modern Plantation Systems: Unlike the scattered nature of the wild/ semi-wild groves, a more modern plantation system was promoted and adopted where oil palms were arranged in dense rows and cultivated in large estates. This system promoted a triangular planting pattern, optimizing space utilization, sunlight penetration, and efficient management. Such a structured approach encouraged significant capital injections into plantation and nucleus estate projects, massively expanding cultivated areas and significantly boosting productivity.

Improved Breeding Programs: Investment in research and breeding programs led to the development and widespread adoption of high-yielding tenera oil palm seedlings, which replaced the traditional dura variety. The introduction of pollinating weevil in the 1980s further increased oil production by improving fertilization, fruit sets, and oil contents. As a result, high-density plantations with these hybrid tenera palms significantly boosted palm oil production.

As a result of these advancements, palm oil traders, once heavily reliant on West Africa, found a more dependable and cost-effective source in these countries, resulting in their explosive growth. Malaysia and Indonesia overtook Nigeria as the world's largest palm oil producers, with both countries now producing over 80% of total global output and Indonesia alone contributing 59%.

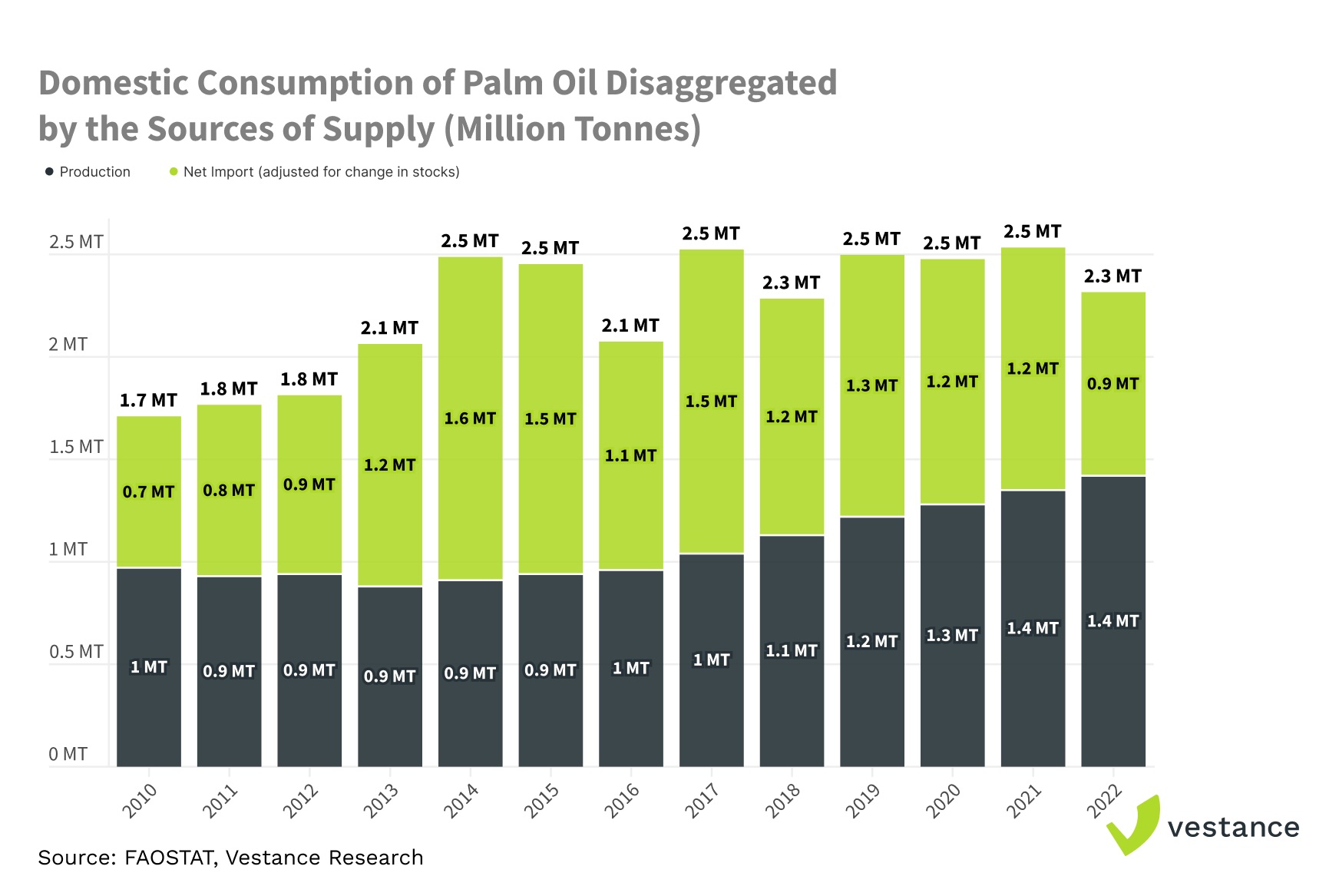

In contrast, Nigeria's palm oil industry became relatively uncompetitive, leading to a steady decline in its global market share — from a commanding 43% in the 1960s to less than 2% today. Presently, the country stands as Africa's largest consumer and importer of palm oil, consuming over 2 million metric tonnes yearly. In comparison, domestic production currently stands at 1.4 million metric tonnes — a deficit of about 1 million metric tonnes covered by importation. In 2019, the Central Bank of Nigeria (CBN) introduced the Oil Palm Development Initiative, aimed at closing the palm oil supply gap, achieving self-sufficiency, and capturing a larger share of global markets. Although imports have relatively reduced with a slight uptick in production levels since then, self-sufficiency remains an elusive target.

Based on the current size of the palm oil market, if Nigeria had maintained its share of production in the 1960s, it would have generated at least $20 billion in revenue in 2023. To put into context, crude oil exports, representing a significant share of Nigerian exports, generated about $19 billion in revenue in the fiscal year of 2023. Essentially, the income from palm oil alone rivals what the country currently earns from its most valuable export. Having such additional income from palm oil exports would have improved Nigeria’s foreign exchange (FX) condition and reduced pressure on the Naira — facilitating a better trade balance and enhanced foreign reserves.

Thus, revitalising the palm oil sector is an economic opportunity and a strategic imperative for Nigeria’s long-term prosperity and stability.

Prosperity through palm oil

The oil palm industry is a golden opportunity for economic growth. It can meet the soaring demand for vegetable oils and other goods both domestically and internationally. However, to fully tap into this potential and remain competitive globally, Nigeria must boost productivity across the value chain.

One key step is organising smallholder farmers into clusters to reduce fragmented oil palm cultivation, thereby easing the production flow between farmers and processors. This aggregation will enhance efficiency through the economics of scale, ensure consolidation of resources, distribution support, access to better infrastructure, quality inputs, off-takers, and processing.

Moreover, Nigeria must develop a more robust land use act and framework for a streamlined land ownership and acquisition process. This is necessary because complicated land acquisition and ownership processes discourage long-term investments and deter large-scale oil palm production (or processing).

Ensuring sustainability by encouraging compliance with Roundtable on Sustainable Palm Oil (RSPO) and European Union Deforestation Regulation (EUDR) requirements is also essential. This can be achieved through robust monitoring measures, agroforestry systems, and financial incentives. Meeting these standards will enable exports to premium markets, increasing profitability as production ramps up.

Investments in plantations, infrastructure, research, and better financing through public-private partnerships are crucial. Enacting business-friendly policies and economic incentives, such as tax breaks and accelerated depreciation, will attract private investment, particularly in the processing segment, which is vital for growth.

With a trade value potentially exceeding $100 billion in the next decade, the growth of the global palm oil industry is inevitable. Through proper policy and capital allocation in this sector, government and private investors in Nigeria can boost productivity across the value chain, driving income and economic prosperity.

This article is an excerpt from the upcoming Vestance Report on the Palm Oil industry in Nigeria.

About Vestance

At Vestance, our mission is to be the foremost catalyst of sustainable agricultural transformation in Africa by empowering agri-businesses and governments with high-quality and data-driven insights, knowledge, innovation, and resources.

Resources

Central Bank of Nigeria. (2019). Oil Palm Development and Expansion in Nigeria. Retrieved July 2024

Corley, R. H. V., and Tinker, P. B. (2015). The Oil Palm. John Wiley & Sons. Retrieved July 2024.

Henson, I. E. (2012). A Brief History of the Oil Palm. In Palm oil (pp. 1-29). AOCS Press. Retrieved July 2024

Holland, J. R., and Moffatt, I. (2005). The Economics of Agricultural Commodity Markets. Agricultural Economics, 32(2), 169-179. Retrieved July 2024

International Institute for Sustainable Development. (2023). 2023 Global Market Report: Palm Oil. Retrieved July 2024

OECD. (2022). Palm oil: Nigeria. Retrieved July 2024, from The Observatory of Economic Complexity

PIND Foundation. (2020). Mapping of Oil Palm Clusters in Niger Delta states of Nigeria. Retrieved July 2024

U.S Department of Agriculture. (2024).Commodity view: Palm oil. USDA Foreign Agricultural Service. Retrieved July 2024.